Franchising makes up 12% of our US GDP – a huge economic impact. But is it right for you? Read on.

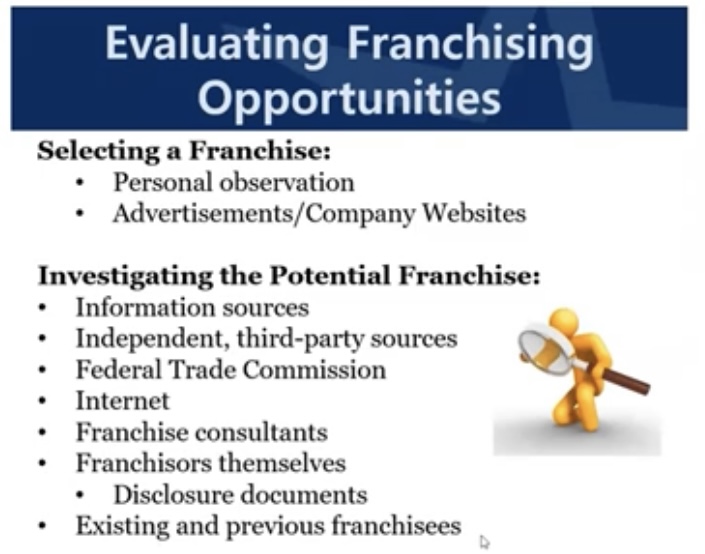

Go to entrepreneurship.com and look at the list of 500 largest opportunities in franchising, says George Ray III, a consultant for Florida SBDC at FIU who specializes in franchizing. ThIe website contains a lot of information about them, including costs. Once you have an idea of what’s out there and there’s something that appeals to you, you can begin to weigh the pros and cons and do your research.

The Pros: There’s probability of success because it’s a proven concept and a new owner will be pre-qualified. Franchise-provided training and financial assistance are typically available, and there are other benefits that come with being part of the franchise. Advantages include a reduced risk of failure and immediate economies of scale. “You are going into business for yourself, not by yourself,” Ray said.

Cons: The cost of franchising can mount. The average initial franchising fee is $30,000, and there are investment costs, royalty fees, advertising costs and other fees. There also may be restrictions on business operations, such as hours you can operate and possibly rules aboutyour territory. This also brings loss of independence and there lack of franchisor support if you make the wrong choice.

There are many high quality franchise businesses out there but it’s very important to do your due diligence, Ray says. “If they try to rush you into a deal, run away.”

Study the restrictions on sales territory. They can restrict when you can sell, the advertisements and more, he said. “If you don’t lke rules, franchsing is not for you.”

Another tip from Ray: Look for something that has an exisitng infrastructure. You don’t want to have to mess with permitting.

Study the FDD – Franchise Disclosure Document – closely. It should list pertinent financial inforation, top performing stores, revenues, etc. They are not going to tell you anything they are not required to, so be prepared to ask questions.

Costs can be negotiated. “Life is not about what you get, it is what you negotiate,” Ray says.

Your due diligence should include speaking with other franchisees. Former ones, as well. How healthy is franchisor-franchisee relations?

Some questions to consider: Is the business in-demand and profitable? Is it in a prime location? What is the reputation of the franchisor? Do they require the owner to operate? If so, that;s a good sign, Ray said.

If you are new to business operations, a franchise right for you. What’s more, the SBA offers loans for franchises.

You’ll need to assess:

- How much total investment will this franchise take?

- How much operating cash will you need?

- How long will it take to get to breakeven?

- What financing opportunities exist for you?

- How financially strong is the franchise?

With all of these questions, the Florida SBDC at FIU and other FSDC offices have specialists, including Ray, who can help you assess if franchisingy is right for you — at no cost. “We’re here to help you,” Ray says.

International Frnchise Association is a good networking organizationnatiaion to join, he said.

Check out this webinar for more advice about franchising: