While South Florida may hopefully be spared from the worst of Hurricane Isaias if current projections hold, it’s a good reminder about the importance of disaster planning. And remember, disaster planning is to prepare your business for any kind of disaster, including pandemics.

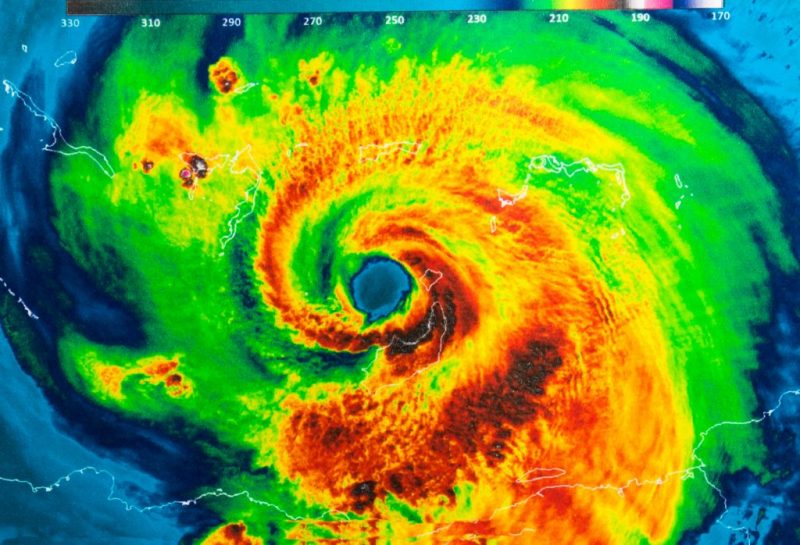

In addition to fighting COVID-19 wrath on our health and our businesses, we are well into hurricane season. Hurricane experts are predicting a particularly active season in 2020, and the most active months are still ahead. Businesses need to be taking basic disaster preparedness steps now. Don’t wait for another imminent threat – those swirl images and menacing cones and track predictions appearing on all the news stations. That is when key steps are missed due to lack of time, resources, or planning.

To be sure, a large-scale disaster like a hurricane is just one of life’s unplanned business interruptions that could set back or even kill your business, said Brian Van Hook, regional director of Florida SBDC at FIU, the small business development center within the university’s College of Business, and a specialist in disaster planning.

A business may be more likely to be impacted by road construction, power outages, flooding, or other business interruptions, Van Hook said in a recent SBDC webinar. A major business interruption can jeopardize the future of the entire business if the right planning is not done.

Florida SBDC at FIU helps business owners to develop a comprehensive business continuity plan. Van Hook said a good start is conducting a risk assessment, developing some table top exercises, and coming up with company-specific checklists to follow pre-and-post-disaster.

GETTING STARTED

To get started, ask yourself these questions:

- Have you done a risk assessment on what risks are more likely to threaten your business?

- Have you done table top exercises to test your response to those specific risks?

- When is the last time you did a visual inspection of the business?

- Are there basic steps you can take today to better prepare your business against future disasters?

Disaster planning is as much about personal planning as it is about business preparations, because how can anyone get back to business if they are worried about your home, children, relatives or pets? Discuss disaster plans with your team. Help them with personal disaster plans. Set deadlines when key items need to be completed by.

Here are a few key things you can do right now to prepare for Isaias as well as the active season ahead:

- Update employee contact information. Make sure that includes emergency contacts and alternate means of communication, such as What’s App for example.

- Identify any special skills, certifications, etc. that your team members possess that might come in handy in an emergency (i.e. first aid, CPR, or military training).

- Ask your team about their plans relative to evacuating vs. shelter-in-place. Also have them identify any childcare needs or if they have other concerns such as pets or elderly relatives.

HAVE A PLAN FOR SUPPLIERS AND CUSTOMERS

Disaster planning is also about having a plan for suppliers and contractors. Maintain current vendor information, contracts and account numbers. Ask your vendors about their continuity plan and if they don’t have one, how will that affect you? Maintain a list of alternate suppliers just in case, perhaps considering geographic diversity. Place periodic orders with your alternate suppliers to maintain active status, he says.

Lastly, your plan needs to include ways you will keep communications open with your customers. Keep a copy of customer records off site or in the cloud and have an alternative worksite from which to communicate with customers during recovery.

But in a recent webinar, Van Hook advises: “Do not overcomplicate your planning. Focus on three to four key action steps and complete them within a defined timeline.”

“The good thing is SBDC is here. We can provide you with training materials, help you with your business continuity plan, with checklists, with emergency preparedness plans — we have a lot of resources we can provide to you to help you get started,” Van Hook said.

These were just a few of the tips Van Hook shared in the SBDC at FIU webinar on Disaster Resiliency. View it here.

RESOURCES ARE AVAILABLE – INCLUDING AN APP FOR THAT

In addition to the webinar, FIU’s Bizaster app is a free tool specifically created for small businesses. It is available in English and Spanish for both Android and iOS. Find out more information about it here.

With the Bizaster app, you can do a risk assessment from the convenience of your mobile device or tablet. You can access checklists, table top exercises and a template for a business continuity plan, Van Hook said.

Miami-Dade and Monroe also offer these resources:

The Ready Miami-Dade (Ready MDC on Apple and Android) mobile application allows Miami-Dade residents and visitors to get up-to-the minute information before, during and after a hurricane strike, including: 1) How to prepare for a hurricane; 2) Areas that are in danger of storm surge; and 3) Evacuation center locations.

Alert!Monroe, an Emergency Notification System from Monroe County, provide you with critical information quickly in a variety of situations, such as severe weather, emergency road closures, boil water notices, water service interruption, missing persons and evacuations of neighborhoods.

A FEW WORDS ABOUT INSURANCE

It’s important to remember that Insurance is only a partial solution. Insurance cannot replace lost customers nor can it cover all losses. Talk with fellow business owners about their disaster experiences. Are their losses included/excluded under your policy?

As far as pandemics, some insurers have excluded losses from them from their coverage. Be sure to ask about that if that’s important to you.

Additional questions to ask your insurance agent include:

- If my policy is a “named perils” policy, what perils are covered? Are there any possible causes of loss that could impact my business that are not covered? Would an open perils policy cover those types of losses?

- What types of losses are excluded under this policy? Which ones might be particularly relevant to my business?

- Would a blanket policy (for multiple locations) be helpful to me?

- Are there any premium discounts that I could be eligible for? Can I do anything else to get [additional] premium discounts?

- Is there any exposure that you are aware of for which I do not have insurance?

AFTER THE STORM

In the event of a disaster, Florida SBDC disaster specialists across the state help affected businesses prepare disaster loan applications. The network will also deploy its mobile assistance centers into communities for affected businesses to receive on-site assistance with disaster loans and other post-disaster challenges.

Should a hurricane hit South Florida, multiple channels provide emergency response and recovery information. These include Florida SBDC at FIU , Miami-Dade County, Monroe County, individual municipalities, and the State of Florida.

A small business will be able to check the SBA website to see if SBA Disaster Loan assistance is available. That website is here.

The business also can check the State of Florida’s Emergency Bridge Loan website to see if those bridge loans are available. That website is here.

After Hurricane Irma, Stephanie Vitori, owner of Cheeseburger Baby, lost power for two weeks but used a generator from one of the food trucks to power the restaurant and begin the recovery process – which included feeding local officials and volunteers helping with the post-hurricane clean-up. Vitori received an SBA disaster loan for $197,000 to cover working capital needs and repair costs. The SBDC at FIU helped Cheeseburger Baby, one of 187 businesses that the center worked with following Hurricane Irma, secure the additional funding to help her make repairs, return to pre-storm staffing levels, and ramp back up her catering operations – as well as assist the company with a business continuity plan.

“If it wasn’t for the SBDC and the SBA, I wouldn’t be here, Cheeseburger Baby wouldn’t be here,” said Vitori, in an earlier video interview. “The SBA and the SBDC were my first responders. … They were able to help me every step of the way.”

UPDATE: Watch a new SBDC at FIU webinar on disaster preparedness here:

Please send GrowBiz topic suggestions and feedback to GrowBiz@FIU.EDU.