By Jennifer Lobb / Guest Contributor

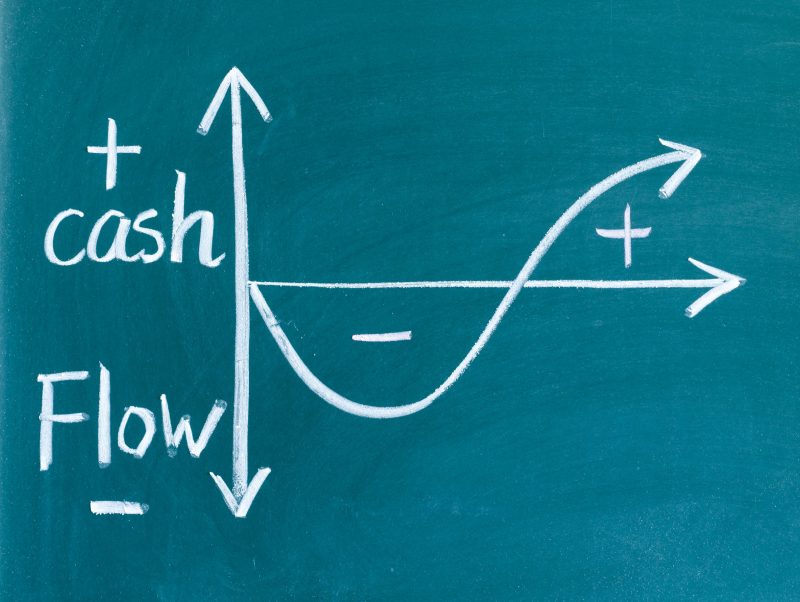

A variety of metrics can determine the health of your business, but few are as indicative of success or failure as negative cash flow, or the net amount of cash that flows in and out of your business. A positive cash flow is essential for growth, but how do you go about improving cash flow for your small business?

The answer: Increase revenue and decrease expenses. At face value, the answer is simple, but the challenging part is enacting change and creating strategies that yield those results. However, an examination of your operational expenses, payment practices, accounts payable, and marketing and sales efforts can help you find ways to improve cash flow in 2020 and as a result increase your cash reserve.

How to Improve Cash Flow

- Work With Vendors & Suppliers

- Reevaluate Spending

- Become More Efficient

- Standardize Billing

- Make it Easy to Pay

- Utilize Invoicing & Accounting Software

- Incentives & Penalty Policies

- Use Invoice Factoring

- Review Pricing Practices

- Evaluate Marketing Efforts

- Identify & Target New Markets

- Consider Selling Online

Operational Expenses

Bringing in income is an important part of the cash flow equation, but the money that flows out can quickly and unapologetically leave you in the red. To close out the year, do some 2018 recon to make sure that your operating expenses are in check. Consider improving your inventory management to cut operational costs as well.

- Work with Vendors & Suppliers

Product inventory and operational goods and services provided by suppliers and vendors are essential line items, and if you’re just adding them up at the end of the month without question or exploration, you may be spending more than you have to.

Do you have a healthy, long-term relationship with your vendors and suppliers? Consider working with them to renegotiate prices, credit terms, and/or secure discounts for bulk orders, both of which can cut costs.

- Reevaluate Spending

Are you paying for a lot of goods or services that you simply don’t need? Can you cut some of the line items out of your monthly budget? Over time, small yet unnecessary expenses add up. You need to reevaluate your cash flow strategy.

Though it’s easy to forget about or overlook trivial expenses., they can often leave you paying hundreds of dollars, if not more, in unnecessary bills and fees over a year. It’s always a good idea to work to improve your cash-flow management. Take a hard look at your bills and determine where you can make cuts, even if it’s momentarily.

- Become More Efficient

Realistically, the notion of “efficiency” in your business is worthy of its own post, if not a series, but in the case of cash flow efforts, it’s essential to mention. Efficiency can mean everything from how you use utilities to how you schedule your workforce.

The new year is a good time to look at ways you may be able to cut back without harming sales and revenue. Small things, like using smart technology to control heating or cooling efforts, using more efficient equipment, turning to automated business software, or reorganizing workstations can make your business operate more efficiently and therefore cost you less in utilities, inventory, and wages.

Getting Paid

- Standardize billing

When your plate is full, as it often is, it’s easy to let some operational tasks fall behind. Don’t let invoicing be one of them. Send out your invoices on time every month and keep due dates consistent. Doing so will set clear expectations about the financial arrangement between you and your customers, and can help you meet your financial goals.

You can also make arrangements to accept credit card or online payments to make this process easier. Where possible offer incentives to customers paying upfront.

- Make it easy to pay

If you only accept one or two forms of payment like cash or debit card or credit card payments, it may be time to consider adding some more options to accommodate the needs of your clients and customers. This may mean offering online payment options or setting up an auto-deduct option, something that can really benefit cash flow.

- Utilize invoicing & accounting software

Utilizing payment and accounting software can ease the burden of invoicing while increasing the speed and regularity of it. Zoho, FreshBooks, and QuickBooks are all excellent options and can offer you instant access no matter where you are. This likely won’t require any new equipment, although a point of sale machine could help with certain changes.

If you’re not already using accounting or invoicing software, the new year is an excellent time to start, as they can also help you manage and organize your monthly, quarterly, and yearly finances.

- Incentives & penalty policies

Sending an invoice doesn’t automatically translate to payment, and if cash issues often stem from lack of payment, then the new year may be a good time to implement new payment policies.

In some cases, this means offering an incentive to entice customers to pay on time or early. For example, customers who pay early may be entitled to a small discount, while customers who pay on time every month for a specified period may receive a discounted product or service.

In other cases, specifically when you’re not getting paid, the pendulum must swing in the other direction – penalties. A penalty or late fees for late payments for a certain number of days late can help customers or clients prioritize your bill in an effort to avoid unnecessary fees. In extreme cases, you can even set a system for collections. Consider debt collection services to get past due invoices paid.

If you decide to add an incentive or penalty, be sure to give your customers adequate notice in writing.

- Use invoice factoring

If you still have problems collecting, you may want to consider invoice factoring, which is when you sell your unpaid invoices to an invoice financing company in exchange for a certain percentage of the value (80-85%) up front. Once the company collects on the invoices, they will give you the remaining about minus a percentage paid in fees.

While it may not be a long-term financing option like a bank loan and paying daily or monthly payments can pose their own problems to your monthly cash flow, it can help free up cash that’s locked up in accounts receivable when you’re in a cash crunch.

Upgrade marketing & sales efforts

Maybe the problem isn’t getting paid but how much you get paid or how many customers you have. A review and upgrade of your pricing policy and marketing efforts can help increase cash flow and market share.

- Review pricing practices

If you’re getting paid on time, or if your business cash flow doesn’t depend on invoicing, then stagnant or decreasing revenue may be due to outdated or inefficient pricing. Are your prices so high that you are losing business to similarly structured competitors? Or, conversely, have you been undercharging and dipping into your contribution margins?

There are a number of reasons that your pricing may be inefficient, but before you jump into a pricing overhaul, take the time to review all factors and how they’ve changed over the last month, quarter, or year. As part of your evaluation it’s essential to account for manpower and wages; equipment, vendor, and supplier fees; and competitor prices.

- Evaluate existing marketing efforts

Are you relying heavily on email marketing but not really seeing the fruit / profit of your efforts? Have you left your social media account get a bit dusty? Do promotions and sales that once sent your bottom line rocketing into the green now barely cause a blip?

Sometimes marketing efforts can become stale and predictable, leaving your customers feeling lackluster about purchasing. As you enter the new year, take inventory of your existing marketing efforts and determine where you may be able to make changes to amp up your existing and engage new customers.

- Identify & target new markets

In some cases, this may be as simple as some thoughtful and creative brainstorming that results in new ways you can market your product or service to other consumers based on their needs (e.g., problem/solution marketing). In others, you may need to do some significant consumer research and examine the efforts of your competitors or potential competitors.

One great way to identify new markets is to actively engage the correct social media accounts.

Doing so can put your brand and products in front of more and more potential clients or customers and engaging with those customers can help you determine new and existing ways to market your product or service.

- Consider selling online

If you’re a brick and mortar company with a thin online presence, and if it’s economically and logistically reasonable to sell your product online, you may want to consider reaching a new audience through e-commerce. There are a variety of easy-to-use platforms, like Etsy and Shopify, that may be able to accommodate your needs.

Before you dive into online sales, take the time to evaluate the costs of doing so, including transaction and website/storefront fees, shipping, and taxes. It may very well boost your cash flow, but it can also impact your bottom line in a negative way. Each business is different, and it’s important to evaluate the fees before opening to the online community.

There is no single answer or approach to increase cash flow in the new year, and oftentimes small business owners find that it’s a combination of practices that result in improvement. Take the time to evaluate your operational, payment, and marketing efforts to see how you can increase income and bring more money in while decreasing expenses.

This article originally appeared on Nav.com.

Jennifer Lobb, a writer for NAV, enjoys finding unique ways for freelancers and startup businesses to reach and expand their goals.